Table of Contents

- Understanding Market Value

- Signs of a Good Deal

- Researching Neighborhoods

- Inspecting the Property

- Timing the Market

- Negotiating with Confidence

- Making the Final Decision

- Resources and Tools

Understanding Market Value

Securing a valuable deal in the housing market is no small feat. The first step is to understand market value thoroughly. Market value is not a constant; it fluctuates based on several factors. These include the property’s location, current demand, and overall condition. In many cases, a higher value is placed on homes in desirable locations with a range of amenities and a history of value appreciation. One example to study would be Ketchum Homes for Sale, where properties can demonstrate these characteristics. Delving into the specifics of comparable sales, commonly known as “comps,” will allow you to assess whether a property is priced above or below market norms.

Signs of a Good Deal

Identifying the tell-tale signs of a good property deal involves research, intuition, and awareness of market conditions. Motivated sellers, often driven by the need to relocate quickly or liquidate assets, are prime candidates for under-market pricing. Furthermore, properties that have stayed on the market longer than average also offer room for negotiation. Staying informed about current housing market trends can reveal patterns and signals that indicate an imminent price climb or decline, enhancing your decision-making process.

Researching Neighborhoods

The neighborhood can profoundly influence a property’s current and future value. When researching neighborhoods, consider the local crime rate and the quality of schools. This information is typically accessible through municipal websites or platforms like Zillow. The right neighborhood often translates to better long-term investments, especially in communities that are undergoing revitalization. Visiting these locations at various times of day can give you a sense of the community vibe and any potential red flags, such as traffic congestion or noise levels.

Inspecting the Property

Conducting a stellar inspection of any prospective property is crucial. Whether you’re looking at structural issues or minor repairs, knowing the home’s actual condition can prevent costly surprises down the line. Focus on critical areas such as the roof, foundation, plumbing, and electrical systems. Engaging a certified home inspector can provide a comprehensive overview of repair needs and potential expenses, which can be a significant factor in deciding whether to proceed with a purchase. This step ensures you are well-informed about the actual state of the property, far beyond its curb appeal.

Timing the Market

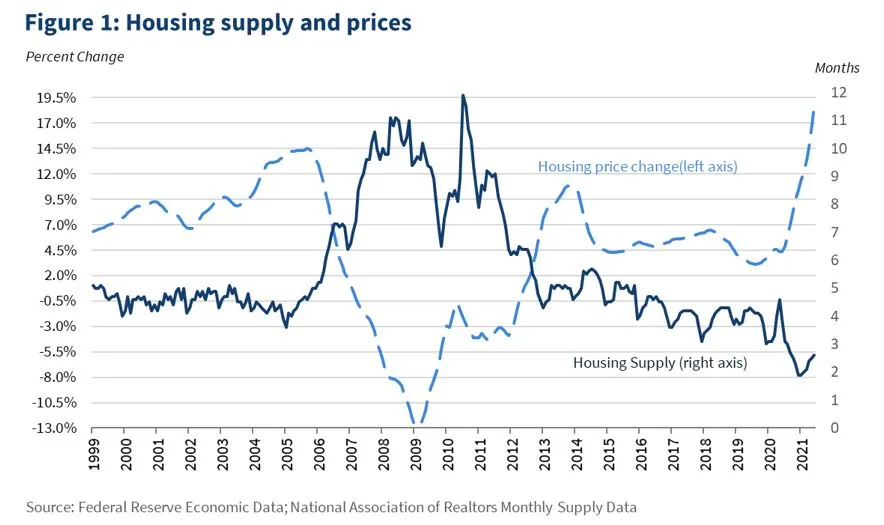

Recognizing the best time to buy can significantly affect your investment’s success. The real estate market is known for its seasonal fluctuations, with winter months generally seeing slower activity and potentially better bargains. Economic indicators such as interest rates and national housing trends should be on your radar, as they can widely influence pricing. For example, a drop in interest rates can open the market to more buyers, driving up prices. Conversely, economic downturns offer unique opportunities to snag a property at a reduced cost if you have the financial stability to weather uncertainties.

Negotiating with Confidence

Bringing confidence and preparedness to the negotiating table can make or break a real estate deal. With careful research on comparable sales and evaluating the property’s needs, you position yourself well to advocate for fair terms. Effective negotiation aims to achieve an equilibrium between all parties involved. This involves identifying key non-negotiables while remaining flexible on less critical aspects such as appliances or closing costs. Clear communication of your expectations can expedite the process and create a pathway to a mutually beneficial agreement.

Making the Final Decision

Arriving at a final decision involves synthesizing all the previously gathered information—from market value assessments to neighborhood quality and inspection results. This process should be meticulous, ensuring each aspect aligns with your personal and financial criteria. Consultation with trusted advisors, like realtors or legal professionals, can provide additional perspectives, helping to reinforce your decision. Balancing intuition with analytical judgment often guides buyers to their next home or investment property that genuinely resonates with their aspirations.

Resources and Tools

Various resources support the quest for a stellar deal in real estate. Online platforms featuring real estate listings, mortgage calculators, and neighborhood reviews equip buyers with vital data at their fingertips. Leveraging these tools can translate into more informed and strategic decisions that align with budgetary constraints and lifestyle preferences.